This Looks Like the Last Chapter of the Cycle

The mood is buoyant, the math is unforgiving, and late-cycle markets can climb until they can’t.

Mood and Market

The market does not just discount cash flows; it reflects mood. You can see it right now in earnings calls that lean into ‘AI tailwinds’, in strategy decks that assume capacity will find demand, and in feeds that treat every pullback as a buying opportunity. The data over the last six months has not been uniformly strong, yet price keeps hovering near highs. That is what social mood usually looks like late in a cycle: it downplays negative surprises and highlights whatever fits the bullish story.

My view is straight forward: the probability of a major recession and a major market drawdown during this presidential term is above 80%. This is not a date stamp; it is a window. A market top, especially a generational top, is a process, not a single point in time. It usually builds over many months. We may print another high first. We may even get a 10-20% shakeout that resets sentiment and sets up one last leg. But the combination of mood, math, and market structure suggests that the advance in the S&P 500 (SPX) is in its late chapters, not its opening scene.

Price vs. Money and Narrow Leadership

Start with price versus money. We are paying rich multiples with positive real yields in the background. That matters. For a decade, duration won because money was cheap and plentiful. Today, the market is expensive while the cost of money is also high. You can outrun that for a while if earnings growth accelerates, if productivity improves, and if the dollar cooperates. But the basic math is back: the longer the price ignores it, the harder the reversion tends to be when it comes.

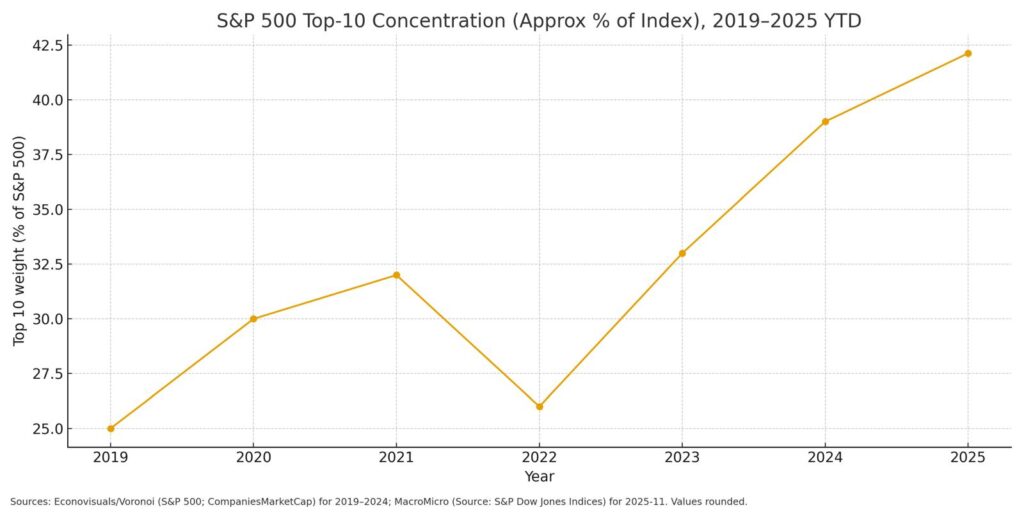

We also have to look at who is doing the pulling. In major U.S. indices, especially the S&P 500, leadership is narrow and breadth is thin. A handful of very large companies are doing an outsized share of the work. That is not a crime; it is a typical late cycle sign. When concentration peaks, idiosyncratic misses become index events and the path gets brittle. Equal weight underperformance is what you see when enthusiasm is real but participation is shallow. The story can continue, but it becomes more fragile.

The concentration numbers back this up. The top 10 stocks in the S&P 500 made up roughly a quarter of the index in 2019 and about the low 40s percent range so far in 2025, based on late 2025 snapshots. That is a large shift in a short period of time and it changes how the index behaves.

S&P 500 Top-10 Concentration (Approx % of Index), 2019-2025 YTD

Debt, CRE, and Policy Friction

Then there is the debt and interest math. We can argue theories all day; compounding does not care. As the public balance sheet swells and interest costs rise, fiscal shock absorbers get thinner. The next time growth stalls, there is simply less room to cushion the fall without raising the cost of capital or crowding out private investment. That does not guarantee a crash. It just means the system is less flexible when it is hit.

Commercial real estate (CRE) is the slow moving piece that markets like to ignore until they cannot. A wall of maturities does not become a headline all at once; it shows up in bank behavior. You end up with offices that never quite refilled, appraisals that have not fully reset to reality, and refinancing math that works only if rates fall sharply or lenders stretch their assumptions. Even if the ultimate losses are manageable, the drag is real: tighter credit for the parts of the economy that hire, build, and spend.

Policy is not a spectator here. Tariffs and industrial policy are back in style. You can like them or dislike them, but they are a tax on trade and a source of cost friction. Layer that onto already elevated price levels and you change the distribution of outcomes: a little less margin, a little more pricing pressure, and a little more risk that so called transitory inflation sticks where you least want it. Late in the cycle, those small changes accumulate.

AI and Narrow Growth

And about AI. I am optimistic about human ingenuity; I am cautious about stories that present AI as an immediate fix for the whole economy. In the near term, most of the gains are likely to be capital intensive and concentrated in a relatively small group of large firms, companies that can afford the big computing bills and already control critical data and distribution.

For those winners, profit margins can expand meaningfully. But that does not automatically translate into broad hiring or strong wage growth. You get pockets of higher productivity, while payroll growth across the rest of the economy remains more ordinary. That is not a recession trigger by itself, but it also is not the broad rising tide some are promising. When sentiment is this bullish, that kind of narrow growth can be mistaken for a new era.

How Tops Form and How I Could Be Wrong

If you are looking for a pattern, it is this: mood stretches, leadership narrows, policy tightens at the edges, financing becomes less forgiving, and then something breaks. It does not have to be a huge villain or a single headline; it can simply be a catalyst that arrives when the system has less room to absorb shocks. We have seen the reverse before, such as tariff scares that bottomed quickly. That is not the call here. The call is for a downturn that does not finish in a couple of days, but for a bear market that works through levels, sectors, and time.

Could I be early? Absolutely. The market could move higher first. If real yields fall while inflation cooperates, if earnings surprise and broaden, if CRE problems prove more contained than feared, and if policy turns out less combative than the rhetoric, this can extend. Late cycle rallies often do. The final stretch is where it is easiest to mistake exhaustion for momentum.

This is a probabilities game, not a matter of faith. I will change my mind if I see a durable expansion in breadth, with equal weight beating cap weight for quarters, not weeks, along with falling real yields that are not driven by a new inflation scare, plus evidence that CRE refinancing is getting done on reasonable terms without quiet public support. Add one more condition: genuine spread of AI driven productivity into the middle of the economy, with small and mid size firms showing sustained revenue per employee gains and hiring. If those show up together, the case that the market is forming a generational top becomes weaker.

The Tape I’m Watching

But that is not what the tape is showing today. The tape looks like a late cycle rally driven heavily by sentiment. Prices can stay firm for a while even after the fundamentals start to soften. That is why I pay attention to the path, not just the destination. You can get a modest correction that barely changes positioning, a push to new highs that pulls in the last skeptics, and then a more damaging decline that grinds across sectors. Market tops, especially generational tops, rarely show up in a single dramatic session. They tend to develop over quarters, with weakness in areas people watch less closely and persistent strength in the names everyone follow.

Every cycle has a dominant story. Right now the story is that America can tariff, spend, and innovate its way through the hard arithmetic. Maybe. But the details, including credit, concentration, and carry, are starting to look similar to the late stages of earlier bull markets. When the narrative and the numbers diverge, investors can stay with the trend for a while, but the underlying risk increases. A strong price trend is not the same thing as safety.

Bottom Line

Bottom line: I believe we will likely see a very large recession within this presidential term, and with it a major market correction that takes time to play out. Another high first? Very possible. A new secular bull market? That would require broader growth, cheaper money, and a fiscal adjustment we have not earned yet.

Until then, respect the mood, respect the math, and do not confuse a high index level with low risk. If you are long, consider hedging or taking partial profits. Yes, the S&P 500 can still climb another 10-15% from its all time high around 6,920, up to the 7,500-8,000 range, but it is worth asking whether that last 10-15% is worth risking the gains you have already built.

This is an opinion for educational purposes only, not investment advice.