This Bull Market in Gold and Silver Is in Its Last Act

We’ve been climbing for years. The question isn’t whether there’s a bull market – it’s where in that bull we are.

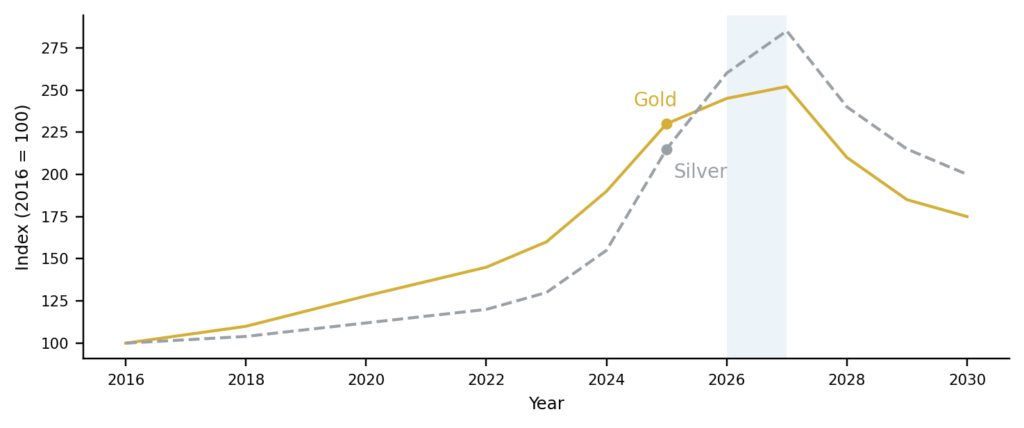

Illustrative Path – Not to Scale

The mood around gold is confident. We’ve gone from debating whether it could reclaim the old 2011 highs to assuming new highs are a matter of time. Every macro story — debt, deficits, geopolitics, real rates — eventually circles back to the same conclusion: gold belongs in the portfolio.

Silver has now started behaving like silver. In the last week or so, it’s added roughly 15–20% and pushed into a zone that forces people to pay attention. That’s typical late‑cycle behavior: the asset that lagged for years suddenly tries to compress several years of catch‑up into a short window.

My belief is simple: we are late in this bull market for both metals. I don’t think the top is behind us. I do think the odds are high that gold and silver both complete this cycle somewhere in the 2026–2027 window, after one more major leg higher. Gold probably tops first. Silver probably chases and overshoots.

This isn’t 2011, but I think it will soon rhyme.

This Isn’t 2011, But It Will Soon Rhyme

The last big top in precious metals was in the early 2010s. Silver spiked first, briefly trading like a speculative tech stock as it rushed toward $50. Gold followed with its own peak near the $1,900–$2,000 zone. No bell rang; prices just stopped rewarding the same stories, and over the next few years both metals slid into the 2015 lows.

That cycle had its own triggers — the financial crisis, euro stress, QE as a new experiment. But the pattern was familiar: a long bull run, a late acceleration, and then a topping process that only became obvious in hindsight.

Today’s backdrop is different — different inflation, different central‑bank behavior, different geopolitical risk — but the rhythm feels familiar. Gold has been grinding and spiking higher since the 2015 lows. Silver has done what it usually does: lag, frustrate, then start moving hard once the narrative gets crowded. That’s why I don’t see this as the beginning of a clean five‑year runway. I see it as the later chapters of a bull that has already put in a lot of work.

A Quick Word on the Gold–Silver Ratio

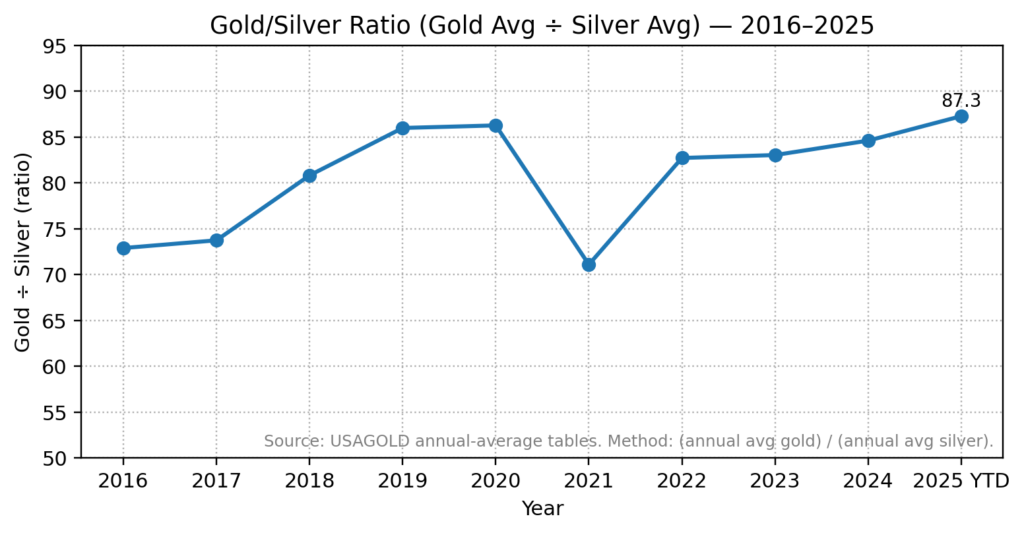

The gold–silver ratio — how many ounces of silver buy one ounce of gold — isn’t a trading system for me. It’s a temperature check.

In big cycles, gold often leads early and the ratio stays high. Later in the cycle, silver tends to catch up and the ratio compresses. Near major tops, that compression can become fast because silver finally sprints.

Our annual‑average ratio chart shows the ratio stayed elevated through most of this cycle — consistent with gold leading and silver lagging for years. Silver’s recent surge is the kind of move that can begin the catch‑up phase, but the proof will be the trend. If silver keeps sprinting, the ratio should start moving lower from here. I’m not waiting for a magic number like 50:1. I care about direction.

Where We Are in the Gold Move

Gold has effectively been in a bull market since the 2015 lows. It’s lived through multiple chances to fail — Covid, policy shocks, real‑rate scares — and kept finding demand. The drivers are well known now: fiscal strain, central‑bank accumulation, geopolitical hedging, and a broad desire to own something that isn’t somebody else’s liability.

At this stage, gold doesn’t look like an early‑cycle trade. It looks like a late‑cycle trend: widely discussed, widely owned, and still capable of pushing higher — but increasingly vulnerable to sharp corrections that reset sentiment.

My base case is straightforward: we likely see a meaningful correction at some point, and then another strong leg higher. That next leg is what I expect to carry gold toward the eventual top of this cycle in the 2026–2027 window.

Where We Are in Silver

Silver is the high‑beta sibling. It tends to do very little for a long time and then compress several years of movement into a short window — which is exactly why it can look sleepy for ages and then suddenly feel unstoppable.

That’s what silver has started doing again. A fast move higher pulls attention back to the trade, invites leverage, and changes the psychology from “this is interesting” to “why didn’t I buy more?”

In a late‑stage metals bull, silver usually doesn’t top years before gold. It tends to run after gold has already proved the trend, and then it overshoots. That’s why I expect silver’s peak to come around, or slightly after, gold’s peak — and why I expect the path to be noisier than gold’s from here.

The Path From Here

I’m not a prophet. This is probabilities, not prophecy. But the setup is clear enough to outline a reasonable path.

First, we can still go higher. Another 10–15% in both gold and silver — maybe more — would not surprise me in a late‑cycle market.

Second, a decent correction in both metals looks very likely at some point. Gold feels better positioned to deliver it first; silver may hold up a bit longer or overshoot before it joins. But in late‑cycle metals moves, corrections tend to be sharp, fast, and sentiment‑resetting.

Third, after that reset, I expect another big run in both metals. In my framework, that next major leg is what takes us into the 2026–2027 topping window — where upside can still exist, but the risk‑reward shifts and the market starts behaving less like a trend and more like a process.

What Might Change My Mind

I’d reconsider this view if:

- The gold–silver ratio refuses to compress even as both metals rise.

- Silver never leads late in the move and behaves like a quiet follower.

- We see a clear regime shift — deeply negative real rates for years with explicit financial repression — that extends structural demand for gold beyond what’s currently discounted.

- Or both metals churn sideways for years, turning what looks like a final act into a long plateau.

Bottom Line

Gold and silver are in a bull market. The question that matters is where in that bull we are.

My answer: late.

I expect gold to top first, silver to chase and overshoot, and both metals to complete their bull cycles somewhere in 2026–2027, after one more major leg higher. I won’t try to call the exact day, but I’m comfortable calling the act: this looks like the last one.

We may still have another 10–15% upside in both metals first. But when the next real correction hits, that drawdown is likely the last clean buy of this cycle — before the final run into the 2026–2027 topping window.

One important caveat: this is a view about the end of the current cycle, not a forever call on gold. Cycles end, markets reset, and new cycles eventually begin. Even if we top in the 2026–2027 window, it does not mean gold and silver “can’t come back.” A multi‑year base and a renewed uptrend toward the end of the decade — or whenever the next regime shift arrives — is completely plausible. The point is simply that the risk‑reward in this particular bull run is shifting from “accumulate” toward “manage and harvest.”

For investors, that doesn’t mean sell everything now. It means recognize that we’re closer to harvesting than planting. If you’ve been long from much lower levels, this is already a good time to hedge. After the next big run, it will likely be a good point to think about trimming, further hedging, or even rotating — rather than telling yourself this can compound at the same pace for another five years.

You can still dance while the music is playing. Just make sure you know where the exits are when it stops.

Opinion for educational purposes; not investment advice