Articles

This section brings together our long-form views: market narrative, cycle analysis, sentiments shifts, and the broader forces that shape risk. Each article is written to clarify how we see the landscape- not to predict, and not as a recommendation to buy or sell any security.

This Looks Like the Last Chapter of the Cycle

The mood is buoyant, the math is unforgiving, and late-cycle markets can climb until they can’t.

Mood and Market

The market does not just discount cash flows; it reflects mood. You can see it right now in earnings calls that lean into ‘AI tailwinds’, in strategy decks that assume capacity will find demand, and in feeds that treat every pullback as a buying opportunity. The data over the last six months has not been uniformly strong, yet price keeps hovering near highs. That is what social mood usually looks like late in a cycle: it downplays negative surprises and highlights whatever fits the bullish story.

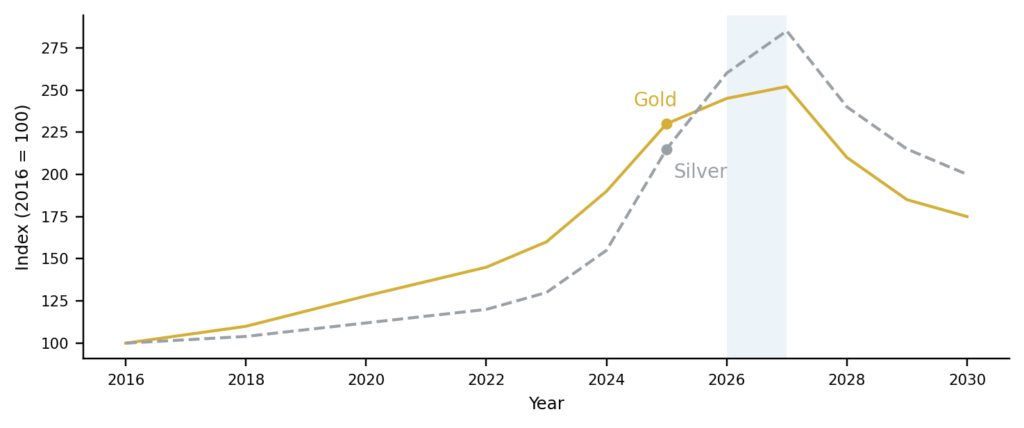

This Bull Market in Gold and Silver Is in Its Last Act

We’ve been climbing for years. The question isn’t whether there’s a bull market – it’s where in that bull we are.

The mood around gold is confident. We’ve gone from debating whether it could reclaim the old 2011 highs to assuming new highs are a matter of time. Every macro story – debt, deficits, geopolitics, real rates – eventually circles back to the same conclusion: gold belongs in the portfolio.